Blog

First United welcomes Jarrod Furgason as Commercial Relationship Manager

Alan Mullendore, Managing Director of Commercial Services at First United Bank & Trust, is proud to announce the addition of Jarrod Furgason as Commercial Relationship Manager, based at the Edwin Miller Community Office.

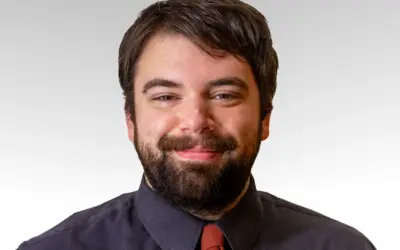

Michael Renzi Promoted

Michael Renzi named Assistant Branch Manager in First United Sabraton Office Brandy Fawley, Community Office Manager at First United Bank & Trust, is pleased to share that Michael Renzi has been named Assistant Branch Manager of the Morgantown Sabraton Office. In...

First United Bank & Trust proudly announces AJ Tasker as Senior Vice President and Chief Operating Officer

Jason Rush, President and Chief Executive Officer of First United Bank & Trust, is pleased to announce the appointment of A.J. Tasker as Senior Vice President and Chief Operating Officer.

Love Is in the Air, But So Are Romance Scams

Romance scams are on the rise, and they can happen to anyone. These scams often start on dating apps, social media, or even through unexpected messages. The goal? To build trust and then exploit it.

Our Cookie Preferences have Updated

To give you more control over your data and create a more transparent browsing experience, we are introducing a new cookie consent pop‑up on our website.

Identity Theft Awareness Week: Steps to Protect Yourself

Identity Theft Awareness Week runs January 26-30, 2026, and it’s the perfect time to make safeguarding your identity part of your everyday routine, just like brushing your teeth or taking out the trash.

First United Bank & Trust announces Kirsten Deering as Engagement Manager

Denise Phelps, Director of Leadership and Engagement at First United Bank & Trust, is proud to announce the appointment of Kirsten Deering as Engagement Manager.

Bulls & Bears First Quarter 2026

Click here to read the latest Bulls & Bears newsletter from first Quarter 2026.

First United Bank & Trust Celebrates Grand Opening of new WestRidge Community Office with Week-Long Event

First United Bank & Trust is proud to announce the grand opening of its newest Community Office at 46 Red Dog Way, Westover, WV 26501. To celebrate, the bank is hosting a week-long celebration from Monday, January 26, through Friday, January 30, featuring daily giveaways, local treats, refreshments, and opportunities for the community to meet the WestRidge team.

First United’s Phil Rodeheaver and Cassandra Bradshaw receive CRCM designations

First United Bank & Trust is proud to announce that Phil Rodeheaver and Cassandra Bradshaw recently earned their Certified Regulatory Compliance Manager (CRCM) designations.

Carissa Rodeheaver Recognized on The Daily Record’s 2025 Banking & Financial Services Power List

First United Bank & Trust is proud to celebrate Carissa L. Rodeheaver on her recognition in The Daily Record’s Banking and Financial Services Power List, honoring leaders who help drive Maryland’s economic growth.

Watch Out for Bank Imposter Scams: What You Need to Know

Have you ever received a text that looks like it’s from your bank? It might say there’s suspicious activity on your account and urge you to act fast. Before you click or respond — pause. It could be a scam.

Boonsboro Ribbon Cutting Event

First United Bank & Trust Celebrates 125th Anniversary with Ribbon Cutting at New Boonsboro Location BOONSBORO, MD. — December 18, 2025 — First United Bank & Trust marked its 125th anniversary with a ribbon-cutting ceremony at its new Boonsboro office,...

Financial Fraud Is on the Rise. Are You at Risk?

More than 1 in 5 U.S. adults have experienced financial fraud or scams involving their money, according to a new survey from the Federal Reserve. The findings come from the Fed’s 2024 report on the Economic Well-Being of U.S. Households, which, for the first time, asked Americans about their experiences with fraud and scams.

First United Bank & Trust Earns Honorable Mention in ABA Foundation’s Community Commitment Awards

First United Bank & Trust has been awarded an Honorable Mention in the American Bankers Association (ABA) Foundation’s Community Commitment Awards, earning finalist status in two categories: Financial Education and Supporting Military Families for its innovative My Finture® Financial Education Center.

First United Bank & Trust Celebrates Ribbon-Cutting at new WestRidge Location

First United Bank & Trust is excited to announce the official ribbon-cutting for its new WestRidge office at 11 a.m. Wednesday, Dec. 17. This modern office, conveniently located at 46 Red Dog Way, Westover, WV 26501, marks a significant milestone as the bank continues to grow alongside the vibrant Morgantown community.

Giving Safely: Avoiding Charity Scams During the Holidays

The holiday season is a time of generosity, reflection, and giving back. But unfortunately, it’s also a prime time for scammers to take advantage of your goodwill. With so many donation requests flooding inboxes, social media feeds, and even text messages, it’s more important than ever to give wisely and protect yourself from charity scams.

December Is Identity Theft Protection Awareness Month. Here’s How to Stay Safe

Identity theft can happen to anyone, and during the holiday season, scammers are especially active. December is Identity Theft Protection Awareness Month, and at First United Bank & Trust, we’re committed to helping our community stay informed and protected.

That USPS Text could be a Scam

Getting a text about a package delivery might seem routine. But if that message includes a link and claims to be from USPS, FedEx, or DHL, there’s a good chance it’s a scam.

Gift Card Scams: What You Need to Know

If someone contacts you by phone, text, email, or social media and tells you the only way to fix a problem is by buying gift cards and sharing the numbers, it’s almost certainly a scam.

First United’s Turf Field Gift Propels Garrett College Athletics Forward

First United Bank & Trust is making a lasting impact on Garrett College athletics. Its recent turf field naming gift pushed the Athletics Capital Campaign past its critical $500,000 goal.

Press Release

First United Corporation Announces Planned Retirement of Chairman of the Board, President & CEO Carissa L. Rodeheaver Oakland, MD — November 14, 2025 — First United Corporation (NASDAQ: FUNC) and First United Bank & Trust today announced that Carissa L....

First United’s A.J. Savopoulos receives globally recognized CISSP designation

First United Bank & Trust is proud to recognize A.J. Savopoulos, Director of IT, for earning his Certified Information Systems Security Professional (CISSP) designation.

First United Celebrates Amy Garner’s Graduation from MBA Emerging Leaders Champion Program

First United Bank & Trust is proud to announce that Amy Garner, Managing Director of Retail, recently graduated from the Maryland Banking Association’s Emerging Leaders Champion Program. This prestigious achievement marks a significant milestone in Garner’s professional journey and reflects her unwavering commitment to leadership excellence.

First United Welcomes Kegan Murphy as Wealth Advisor Associate

First United Bank & Trust is proud to welcome Kegan Murphy as a Wealth Advisor Associate in the Hagerstown, MD, area, announced Shane Small, Vice President and Senior Wealth Advisor.

Grand Opening of New Boonsboro Community Office

First United Bank & Trust Celebrates Grand Opening of New Boonsboro Community Office BOONSBORO, MD — First United Bank & Trust is proud to announce the grand opening of its newest community office located at 207 N. Main Street, Boonsboro, MD. To celebrate this...

Thomas Begley Joins First United as Senior Wealth Advisor – Team Lead

First United Bank & Trust proudly announces the appointment of Thomas Begley, CFP® as Senior Wealth Advisor – Team Lead, serving clients in the Morgantown area. The announcement was made by Chief Wealth Officer Keith Sanders.

Check Fraud: The Archaic Scam That’s Still Costing People Thousands

Even in today’s fast-paced digital economy, where payments are made with a tap or a swipe, check fraud is still very much alive and growing. It may seem outdated, but scammers are increasingly reviving this old-school tactic, taking advantage of the fact that paper checks lack the robust security features built into modern payment systems.

Bulls & Bears Fourth Quarter 2025

Click here to read the latest Bulls & Bears newsletter from fourth Quarter 2025.

Jennifer Junkins promoted to Assistant Community Office Manager role

Amy Garner, Managing Director of Retail at First United Bank & Trust, is excited to announce the promotion of Jennifer Junkins to Assistant Community Office Manager at the Keyser office.

Farewell to the Cent: What You Need to Know

In 2025, the U.S. Treasury announced it will stop producing new pennies as part of an effort to reduce unnecessary government spending. At nearly 4 cents per coin to produce and distribute, the penny has long cost more than its face value.

First United Welcomes Trevor Phillips as Wealth Advisor Associate

Preston Sharps, Senior Wealth Advisor – Team Lead at First United Bank & Trust, is excited to announce Trevor Phillips as Wealth Advisor Associate in Oakland.

First United Bank & Trust welcomes Sarah A. Michael as Wealth Advisor Associate

Preston Sharps, Senior Wealth Advisor – Team Lead at First United Bank & Trust, is excited to announce Sarah A. Michael as Wealth Advisor Associate in Oakland.

Stay Smart, Stay Safe – It’s Cybersecurity Awareness Month

October is National Cybersecurity Awareness Month, and it’s the perfect time to sharpen your defenses against scams and fraud. At First United Bank & Trust, we care deeply about our community, and that means helping you stay informed and protected.

Unlock Smarter Public Sector Investing with LGMAPs

Imagine a smarter way for local governments to manage public funds — one that combines safety, liquidity, and yield into a single, professionally managed investment strategy. That’s exactly what Local Government Managed Asset Programs (LGMAPs) offer.

Mik Ruggiero Earns CompTIA Security+ Certification, Marking a Major Milestone in Cybersecurity Career

First United Bank & Trust is proud to announce that Mik Ruggiero has earned the CompTIA Security+ Certification, a globally recognized credential that affirms foundational cybersecurity expertise. This milestone reflects Ruggiero’s dedication to continuous learning and his commitment to strengthening the bank’s security posture.

Unlocking Your Future: Why Your Mortgage Journey Deserves a Personal Touch

Homeownership is more than just a milestone; it’s a foundation for your future. At First United Bank & Trust, we’ve been helping individuals and families achieve their dreams for 125 years, and we believe your mortgage experience should be as unique as you are.

Don’t Miss the Moment: Fund Big Plans Without Selling a Single Share

When you need quick access to cash without disrupting your long-term investment strategy or triggering capital gains taxes, First United Bank & Trust has you covered. Unlock the power of your portfolio with our Wealth Management Securities-based Line of Credit.

First United names John Hetrick as Community Office Manager for Lake Office

Kimberley Harless, Regional Retail Manager at First United Bank & Trust, is excited to announce John Hetrick as Community Office Manager of the Deep Creek Lake Office.

Carmen Pennington joins First United Bank & Trust as a Regional Retail Manager

First United Bank & Trust is proud to introduce Carmen Pennington as the Regional Retail Manager for the Morgantown area, said Amy Garner, Managing Director of Retail.

Allyson Jones named Community Office Manager at First United’s Riverside Office

Nakisha Aviles-Broadnax, Regional Retail Manager at First United Bank & Trust, is proud to welcome Allyson Jones as the Community Office Manager of the Riverside Office in Frederick, MD.

Watch Out for Student Loan Scams

Scammers are stepping up their game, sending slick emails, making bold promises, and using official-looking logos to trick borrowers into handing over money and personal info.

Garrett County Businesses Warned of Rising Invoice Scams

The Garrett County Chamber of Commerce, in collaboration with the Garrett County State’s Attorney’s Office, has issued an important alert to local businesses regarding a surge in fraudulent invoice scams.

Coming Soon: First United Bank & Trust opens new branch in Boonsboro

First United Bank & Trust, a trusted financial leader for over 125 years, proudly announces the addition of its newest branch in Boonsboro, MD. This expansion marks a significant milestone in the bank’s commitment to serving the growing needs of the Boonsboro community.

Don’t Let Travel Scams Ruin Your Vacation

From fake travel sites to phishing emails that look like they’re from your favorite airline, fraudsters are getting creative.

First United Bank & Trust relocates to new WestRidge office

First United Bank & Trust is proud to announce the groundbreaking of a new office location in the Morgantown area. The Star City office will be relocating to the new WestRidge development, just off Interstate 79.

Donna Burns Joins First United as Deposit Services Relationship Manager

Keith Morgan, Managing Director of Commercial Services at First United Bank & Trust, is excited to welcome Donna Burns to the team as a Deposit Services Relationship Manager in the Morgantown area.

Samantha Ballard named Assistant Branch Manager in First United Suncrest Office

Brandy Fawley, Community Office Manager at First United Bank & Trust, is excited to announce Samantha Ballard as Assistant Branch Manager at Morgantown’s Suncrest Office.

A Legacy of Giving on the Green: First United Hosts 37th Annual Charity Golf Tournament

First United Bank & Trust proudly teed off its 37th Annual Charity Golf Tournament on Friday, July 11, 2025, at the scenic Oakland Golf Club. As the event’s organizer, First United has helped turn this tournament into a cherished community tradition. Over nearly four decades, the event has raised an impressive $700,000+ for Garrett County charities — proving that a great day on the course can also make a powerful impact.

First United promotes J.T. Bowling to Mortgage Relationship Manager

Scott Hostetler, Vice President and Director of Mortgage Services at First United Bank & Trust, is thrilled to announce the promotion of J.T. Bowling to Mortgage Relationship Manager, working in the Washington County Hagerstown Office.