VISA® Debit Cards

Payment cards are a constant, convenient connection to your financial life. And when you use something every day, it needs to be reliable, and most of all, secure. Our First United debit cards deliver all of the above and then some.

Debit Card Features

Our Visa Debit Cards have many features that work to give you the easiest way to access your account for everyday purchases. Plus, if you want to earn rewards without taking on any debt, a VISA Debit Card is the answer.

My Bank Rewards powered by ScoreCard

Every First United VISA Debit Card comes equipped with My Bank Rewards, powered by ScoreCard. Just swipe and earn points for the things you want most. Choose from merchandise, cash back, travel or even local merchant gift certificates!

Save time with Instant Issue Debit Cards

With our Instant Issue Debit Cards, for Business and Personal accounts, there is no more waiting to receive a card in the mail. Our Instant Issue process allows you get a new or replacement card at any First United Office in minutes!* Plus, you'll have the security of knowing that your new card has a secure chip and contactless capabilities.

* Fees and conditions may apply. Instant Issue only offered with in-office visits. First United does not mail Instant Issue Debit Cards, nor do we prepare them in advance of the customer’s in-office visit.

Contactless Card

A simple and secure tap is all it takes to pay for the things you need. VISA® contactless payments make it secure, convenient and touch-free. Contactless payments are transactions made by tapping either a contactless chip card or payment-enabled mobile or wearable device over a contactless-enabled payment terminal (inidcated by a wave-like symbol). Cards, phones, watches and other devices use the same contactless technology. When you tap to pay checkout is secure, convenient and touch-free.

VISA® Account Updater (VAU)

All First United debit cards also feature VISA Account Updater (VAU). VAU is an account updating service where your card is automatically enrolled at no cost to you. When your card expires or is lost or stolen and a new card is issued and the service will update relevant card data (card numbers and expiration dates) to participating merchants to avoid uninterrupted processing of your charges.

This service provides updates to a VISA database only. The database is accessed by qualified merchants seeking your account information after you have requested they process payments. If at anytime you wish to opt-out of the VAU service or if you have any questions, please contact our Customer Service Center at 1-888-692-2654.

Shop online with confidence!

Your VISA card is equipped with VISA Secure, which helps protect your account against fraud and unauthorized use. Look for online merchants that display the Visa Secure symbol for your transaction to have an added layer of protection. Visa Secure is automatically activated at checkout. It’s quick and easy!

Access 1,000's of ATMs Across the Country

First United is a member of the MoneyPass network, bringing you access to your money all over the country. Find a MoneyPass ATM anywhere you travel!

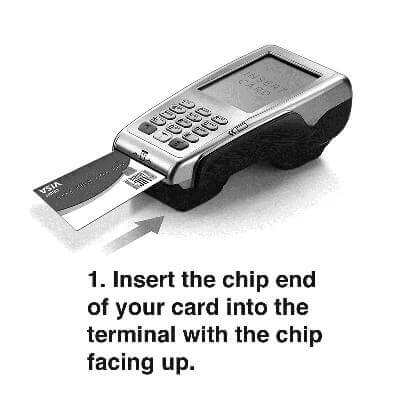

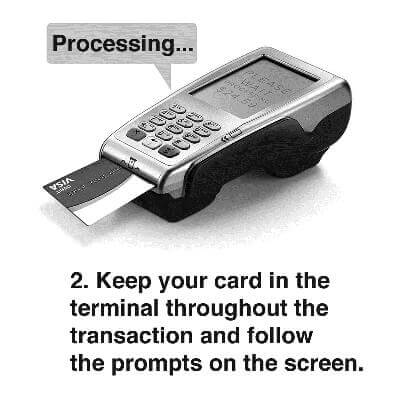

Security in Payments

Our debit chip enabled (EMV) cards feature an embedded chip that improves security with each purchase at chip-enabled terminal. This brings you enhanced fraud protection by creating a unique code for each chip transaction, preventing card data from being fraudulently used. As more stores and restaurants around the world are using chip card readers, you can use your card in the U.S. and abroad with even more confidence.

Mag-Stripe Still Accepted

If a merchant hasn't switched to the new chip card reader, don't worry! Your card will still have a magnetic stripe for use at traditional retailers. For online and phone purchases, you can continue to place orders the same way you do today!

- For a First United Visa Check Card, the ATM withdrawal limit is $1,000.

- For a First United Visa Check Card, the point-of-sale (POS) transaction limit is $5,000.

- For a First United ATM Card, the ATM withdrawal limit is $300. (ATM cards may not be used at a point-of-sale).

- For a First United Health Savings Card, the point-of-sale (POS) transaction limit is $2,500.00. (Health Savings cards may not be used at an ATM).

- All limits noted above are per card, per day. To request an exception to these limits, please contact the Customer Care Center or your local branch.

To activate a VISA debit card, you must first use it with your PIN at any ATM or may call 1-800-218-1014 (Select Option 6; your PIN number is required).

Your First United Debit Card or ATM Card PIN is your Personal Identification Number. The number which you will use during transactions and at the ATM terminals to use your card.

Debit Card PINs are mailed separately from the card for security purposes. PIN mailings typically arrive 1-2 business days before your card. (With Instant issue cards, you will select your PIN in the office.)

If you have forgotten your PIN, the Customer Care Center or any community office can order a PIN reminder from VISA, which will arrive by mail. Your PIN can also be reset at any First United community office. To reset your PIN, you will need to have the Debit/ATM card and appropriate photo ID.). We do not keep PIN Numbers on file.

If you would like to update or change your PIN, you may do so by calling 1-800-218-1014 or by visiting any First United ATM. You will need to know and enter your current PIN to update your information.

If you still have any questions regarding your PIN, please contact our Customer Care Center at 1-888-692-2654.

Additional Safety Tips to Stay Secure

Security of your card and PIN number

- Please sign your card upon receipt.

- Destroy your old card when it expires or when your new card becomes effective.

- Memorize your PIN. Do NOT write it on the back of your card or keep it with you.

- Never disclose your PIN to anyone.

- Keep a written record of your PIN entirely separate from your Card.

- Keep your Card in a safe place.

- Remember to pick up your ATM receipts before leaving the ATM.

- Safeguard your account number. Always obtain merchant receipts and destroy carbons

Security When Approaching the ATM

- Be alert - look around the area.

- Leave immediately if you see or sense anything suspicious.

- Always have your Card in hand, ready to use.

Security While at the ATM

- Allow a comfortable distance between you and the person using the ATM.

- Respect any line barriers that say “Wait Here".

- Do not walk up to the ATM before the current user has left.

- Use your body to shield the ATM's keyboard from another person's line of sight.

- Don't stop to count the money or expose it for others to see.

- Place all money into your pocket or purse immediately.

Security When Leaving the ATM

- Remain alert - watch for strangers who may approach or follow you.

- Keep safe distances between you and others.

- If someone follows you, go to the nearest populated place such as a store or restaurant.

Refuse Telephone Inquiries

- Do not reveal any information about your Card over the phone.

- Verification of your Card account(s) and PIN should only take place in person at your financial institution.

- If you receive a call about your Card, contact your financial institution immediately and we will suggest the next course of action.

Report Theft or Loss Immediately

- Call 1-888-692-2654 to report a card lost or stolen. During non-business hours, you may also call 1-800-236-2442.

- The non-business hours telephone number noted above is typically used only for reporting the cardlost or stolen.