Credit Insights

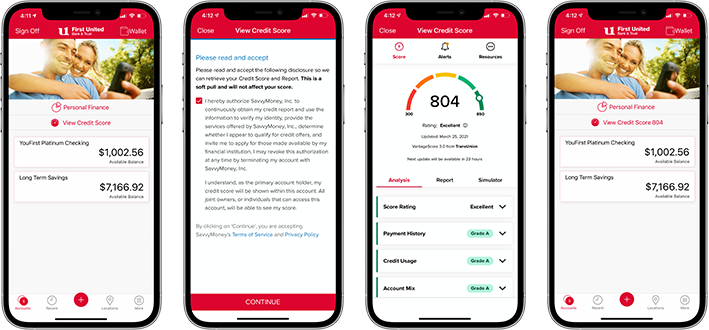

Credit Insights, is a helpful credit reporting, monitoring, and education tool offered right in our Mobile App! First United has partnered with SavvyMoney, bringing you a direct view into your credit reporting information. This valuable tool will break down and grade each section of your report and provide specific insights to best manage your score. And, unlike many other tools, Credit Insights can provide your real-time credit score with a daily refresh!

- Understand the factors that impact your score

- Receive daily credit monitoring alerts for major changes

- Identify credit bureau errors

- Work toward your financial goals

SavvyMoney is a comprehensive Credit Score program offered by your financial institution, that helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score, and can see the most up to date offers that can help reduce your interest costs. With this program, you always know where you stand with your credit and how your financial institution can help save you money.

Credit Score also monitors your credit report daily and informs you by email if there are any big changes detected such as: a new account being opened, change in address or employment, a delinquency has been reported or an inquiry has been made. Monitoring helps users keep an eye out for identity theft.

SavvyMoney Credit Report provides you all the information you would find on your credit file including a list of open loans, accounts and credit inquiries. You will also be able to see details on your payment history, credit utilization and public records that show up on your account. Like Credit Score, when you check your credit report, there will be no impact to your score.

No. SavvyMoney is entirely free and no credit card information is required to register.

As long as you are a regular online banking user, your credit score will be updated every week and displayed in your online banking screen. You can click “refresh score” as frequently as every day by navigating to the detailed SavvyMoney site from within online banking.

SavvyMoney pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges: Excellent 781–850, Good 661-780, Fair 601-660, Unfavorable 501-600, Bad Below 500.

No, First United Bank & Trust uses its own lending criteria for making loan.

No, your SavvyMoney Credit Score is a free service to help you understand your credit health, how you make improvements in your score and ways you can save money on your loans with First United Bank&Trust.

SavvyMoney uses bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

SavvyMoney Credit Score can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home, car or paying for college—you have a clear picture of your credit health and can qualify for the lowest possible interest rate. You’ll also see offers on how you can save money on your new and existing loans with First United Bank & Trust.

The SavvyMoney Credit Score makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within their SavvyMoney Credit Report. However, The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.

Based on your SavvyMoney Credit Score information, you may receive FIrst United Bank & Trust offers on products that may be of interest to you. In most cases, these offers may have lower interest rates than the products you already have. The educational articles, written by Jean Chatzky and the SavvyMoney team, are designed to provide helpful tips on how you can manage credit and debt wisely.

No. Checking SavvyMoney Credit Score is a “soft inquiry”, which does not affect your credit score. Lenders use ‘hard inquiries’ to make decisions about your credit worthiness when you apply for loans.

Yes. SavvyMoney will monitor and send email alerts when there’s been a change to your credit profile.

If you access SavvyMoney program through Mobile Banking, you have to do nothing! Your email address will get updated automatically in SavvyMoney when you update it through Online Banking. However we always encourage you to inform First United Bank & Trust of any contact information updates.

Yes, actually SavvyMoney Credit Score is only available for both mobile and tablet devices at this time and is integrated inside our mobile application.

Disclosures

First United Bank & Trust has partnered with Savvymoney to offer Credit Insights to customers, terms and conditions for this service are available within our Mobile App, once enrollment is complete. Credit profile pulled from Transunion and uses VantageScore3.0. Checking Credit Score is a “soft inquiry”, which does not affect customer’s credit score. This service is available on smartphone apps, version 5.0 and higher. This feature will not display on tablets at this time.

Transfers and withdrawals from certain types of accounts to another account or to third parties by pre-authorized, automatic, telephone, computer transfers, check, draft, or similar order to third parties is limited to six (6) per month or statement cycle. Fees may apply. Please ask for details or a copy of the current fee schedule by contacting Customer Service Center at 1-888-692-2654.