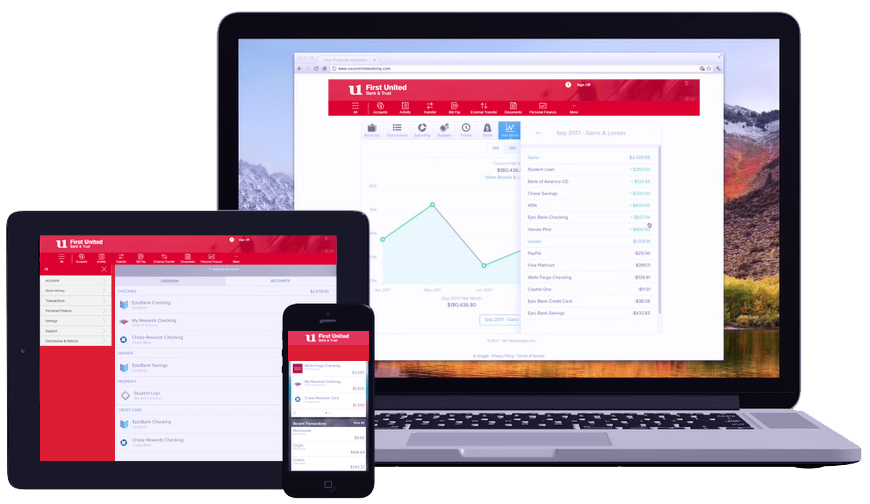

Personal Finance Tool

Control your money. Don’t let it control you.

Personal Finance is a digital money management tool that empowers you to take control of your finances and simplify your life. This great new tool is easily accessible by clicking the Personal Finance menu option through your First United Internet or Mobile Banking account.

- Access all your financial accounts in one place

- Get powerful insights on where, when, and how you spend

- Tailor your budgets to your life by creating custom budget categories

- Create, manage, and visualize your goals

- Access your accounts anytime, anywhere using your First United Mobile Banking app

Take budgeting and money management to the next level.

Watch this overview and get started today.

The Personal Finance tool is offered through Internet and Mobile Banking. Watch this video for a brief overview of the tool. Keep in mind, in order to view the Personal Finance tool using our Mobile Banking App, you must first be enrolled in Online Banking. Accessing your personal finances using our digital solutions is one more way First United is helping you manage all of your money, all of the time.

Setting Up Notifications

Trends Overview

Manage Your Cash Flow

Getting Started With Accounts

Managing Transactions

Financial Aggregation Explained

Understanding Your Spending

Setting Goals

Understanding Net Worth

Setting Up Budgets

Eliminating Debts

Depending on the number of accounts and the related history, this can take a few minutes at enrollment. Initially, 90 days of history is loaded and once the history has finished loading, new information updates typically take less time.

When you initially enroll, the system pulls in 90 days of activity for each in-house account. This may take time and you may end up seeing the balance but not the activity immediately. Continue with other activities in MX or CEB and check back in a couple of hours. If at that time you’re still not seeing your activity, wait until the following day. If you don’t see the transactions the following day, open a ticket with Zendesk to find out why the process isn’t working as expected.

Security filters may direct emails to your Junk or Spam folder; always check there first. If using the application from a work location, the item may end up in quarantine. Check the list once the list of quarantined items is released to your inbox. It may take a few minutes for the verification email to be delivered.

Sometimes you have to search for an external account using very specific information, so try finding your account using different variations of the name or link.

For example, search by the URL that displays when you log in directly to that external account: https://www.mycardstatement.com/#/

MX may again return the error above, so, try removing the extension after the “.com”: https://www.mycardstatement.com

If the connection is still not found, open a Zendesk ticket describing the issue.

The bank that you’re trying to add doesn’t recognize the aggregator requesting your account information (just like when you log in for the first time on a new or different device). To ensure security, it will require “step-up” authentication, which can include the code from a text message, or answers to personal security questions.

This may be an aggregation / third party security requirement on their part. This is not unusual.

There are several reasons why this can happen – from the online or mobile banking outages to aggregator issues. If the issue hasn’t reconciled itself same day, you can enter a Zendesk help ticket or check the account the following day, the expected account data should be there.

There may be an issue with the aggregator that is currently trying to pull the data from the financial institution. This should be reported through Zendesk.

This is a design feature to ensure financial data security. The description of the account type will be displayed (the account type, NOT a personal “nickname”).

When transactions are initially passed into MX from Internet banking, categories are assigned based on complex business logic. Some transactions however will end up being “uncategorized” because the business logic didn’t find the key data values it’s looking for. Categories can be updated at any time. Once the category has been modified, you have the option of applying that category to future transactions matching that same logic, or just to that one transaction.

Categorization is a critical component to the accuracy of all features within MX so we recommend focusing on refining initially, and ongoing as changes in your financial situations occur.

Categories established in Internet (Online) Banking do not get pulled into Personal Finance, so they will not sync. The categories in MX tie into MX features and related calculations.

Same-day transactions (such as POS / Debit Card purchases and cash withdrawals) do not update immediately within MX. Updates are pushed numerous times during the business day, so, you might not see it until the next one.

Balances for external accounts are only updated once after nightly processing. Any intra-day transactions will not display or affect balances until the following business day.

MX will run in IE however, like most applications today, it was written for Chrome and Firefox. If the page alignment looks “off”, have the user try it in Chrome or Firefox.

Personal Finance includes a direct support system called “Zendesk”, allowing you to submit questions and request assistance from an MX Analyst. Simply click on the “help” icon from the top menu and choose the “Request Support” button.

Enter a full description of your question, and any steps to recreate, then click submit. You will receive a confirmation message, then an auto-resonse email acknowledgement from “moneydesktop” (support@moneydesktop.zendesk.com)

Once an MX analyst has been assigned, they will correspond directly with you directly through the duration of the issue or question.

Disclosures

Click here to read the Personal Finance Terms & Conditions.

Transfers and withdrawals from certain types of accounts to another account or to third parties by pre-authorized, automatic, telephone, computer transfers, check, draft, or similar order to third parties is limited to six (6) per month or statement cycle. Fees may apply. Please ask for details or a copy of the current fee schedule by contacting Customer Service Center at 1-888-692-2654.