YouFirst Plus Checking

An incredible checking account with tremendous benefits! Your checking account is the base of operations for your financial life. Now we made it even more powerful. YouFirst Plus does more than help you manage your finances. This winning solution provides the means to financial wellness, good health, adventure, safety, peace of mind and so much more.

- YouFirst Checking

- YouFirst Plus Checking

- YouFirst Platinum Checking

- Freedom First Checking

- Overdraft Services

- Debit Cards

- My Bank Rewards

- Billshark

- Safe Deposit Boxes

- Reorder Checks

Reordering Checks?

Use Routing Number: 052100987

Cell Phone Protection

Receive up to $600 per claim ($1,200 per year) if your cell phone is broken or stolen.1,2

Identity Theft Aid

Includes payment card fraud resolution, $10,000 in personal identity theft benefit, and identity restoration. 1,2

Buyer’s Protection and Extended Warranty

Newly purchased items are protected for up to $2,500 per item if theft or accidental breakage occurs during the first 180 days of purchase, plus one year extended warranty. 1,2

Shop Local, Save Local with BaZing Savings

Local discounts and national retailer deals to save you money on shopping, dining, travel and more.

Roadside Assistance

Available 24/7 and free to use, up to $80 in covered service charges.

Pet Insurance

Preferred rates on pet insurance. Coverage includes free ID tags linked in pet cloud, 24/7 virtual vet, pet Rx and more!4

Health Savings Card

Save money on prescriptions, eye exams, frames, lenses and hearing services.

$10,000 Travel Accidental Death Coverage

Peace of mind for the unexpected. 2

Anywhere Banking Tools

Online banking, mobile banking, bill pay, mobile deposits, debit card, Zelle® and eStatements or Paper Statements.

Billshark

Let our team of experts negotiate your internet, TV, cell phone, and home security services on your behalf, or cancel subscriptions you no longer want or need.

Rewards

Earn 10x My Bank Rewards points with every qualified purchase.

Electronic or Paper Statements

Enjoy a paper free lifestyle with up to seven years of online document storage, or you may receive paper statements.

ATM Access

Foreign ATM fees waived; free Sheetz & MoneyPass access.

Earn Interest on your Checking Balance

A competitive rate on your balance.

Additional Banking & Wealth Management Benefits

- Personal Credit Line (PCL) annual fee waiver

- Receive 2 official checks per monthly cycle at no cost

- Receive 5 stop payments per monthly cycle at no cost

- Unlimited assisted transfers by phone or in-person

- 20% discount on brokerage trades 2

- 100% discount on annual financial planning consultation

- Instant issue debit card - first card is free, then $10 fee applies

Only $9 per month.

Avoid the monthly service charge by maintaining a $2,500 average monthly balance in this account.

Explore All Our Checking Accounts:

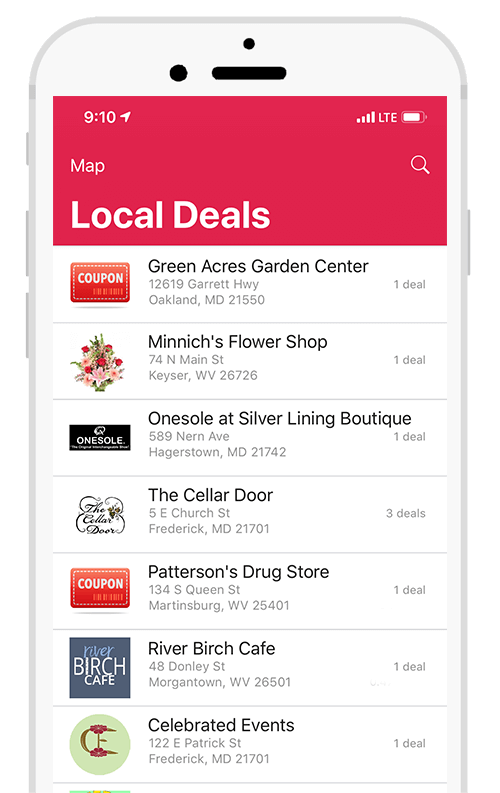

Shop local. Save local.

Get local discounts and national retailer deals on shopping, dining, travel and more. YouFirst powered by BaZing brings you over 450,000 discounts where you live, work or travel. Simply show your mobile coupon to the retailer for instant savings or login at BaZing.com for printable coupons.

Small Business Owner? Join the Discount Network

Joining the BaZing discount network is a powerful way to promote your local business. It's free exposure for you and a valuable benefit for customers. Contact us to learn more on how your business can join the discount network.

![]()

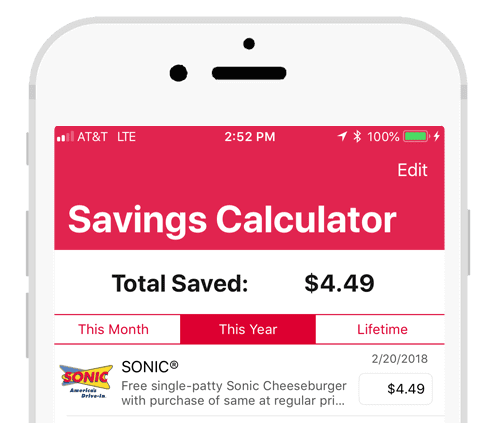

Track & View Your Savings.

You track your steps and your calories. Why not track your savings? See how much your YouFirst account is helping you save each month, year or over the lifetime of your subscription with our simple savings calculator. Simply enter how much you saved each time you use a coupon.

- Step 2: Enjoy the benefits!

Once the account opening is finished, our staff will complete your BaZing enrollment and can assist you with downloading the mobile apps so you can access your new tools and explore your benefits.

Tools You Will Need

YouFirst members can best manage their banking needs and rewards by accessing Bazing.com and downloading these apps!

My Bank Mobile App

View transaction history, pay bills or friends, make a mobile deposit and more using your mobile device. Learn more...

YouFirst App

Access the exclusive savings, discounts and protective services the YouFirst account offers anytime, anywhere!

Be sure you enable location services and select the option “always”. Also, verify notifications are turned on inside the YouFirst app. While logged into the app click on ‘More’. Scroll to Manage Notifications and click. Make sure ‘Turn on Notifications’ is set to on. Sometimes turning it off and on will also help with notification issues.

In the YouFirst app, click Manage Notifications and you can choose to ‘Mute’ certain merchants.

With over 360,000 deals, while rare, there could be an occasion where a deal doesn’t work. With our guarantee, you simply click “I had a problem” and submit a receipt and you’ll receive a check for the amount of the discount you should have received.

Contact Bazing at 1-855-UBAZING (1-855-822-9464) or customer.service@bazing.com

All of the benefits take effect immediately with the exception of the Cell Phone Protection coverage. This benefit begins and renews the first day of the month following a cell phone bill payment from the YouFirst checking account. If a payment is not made in a given month the coverage will be suspended the first day of the following month. Please refer to the Guide to Benefits Cell Phone Protection insurance document on the BaZing website for additional information.

BaZing applications may collect real time location information for the purpose of providing the customer with services but are only done so with the permission of the user. Collection of data/information by BaZing via mobile applications will only include location information and user favorites in order to provide pertinent data regarding service offerings.

With over 360,000 deals, while rare, there could be an occasion where a deal doesn’t work. With our guarantee, you simply click “I had a problem” and submit a receipt and you’ll receive a check for the amount of the discount you should have received.

The BaZing Guarantee states if an offer that is listed on the website or app is not honored and you go ahead and make the purchase as listed on the offer you can send in your receipt with a description of your experience to BaZing Customer Service and we will issue a refund.

You can also send an email to BaZing Customer Service with the merchant name, location and issue experienced. If additional information is needed it will be gathered at that time. Or, if the customer is using the app there is a way to send a notice to Customer Service directly from the app. When you close the offer there are different options to choose. One of those is ‘I had a problem’. This means that for whatever reasons there was an issue with redeeming the offer. When you select that option; you are given the option of adding a picture of the receipt. Simply click the ‘camera’ icon to do that. Then click ‘submit’.

The maximum refund is $100.

You will need to file a claim. The claim form can be printed from the BaZing website or you can contact BaZing Customer Service and they can send you one via email. You will need to fill it out and send in the required documents. After the claim is reviewed you will receive a Summary of Benefits along with a check, if the claim is payable. Please refer to the Guide to Benefits Cell Phone Protection insurance document on the BaZing website for additional information.

If a cell phone is damaged to the point that you cannot make or receive phone calls then you are eligible to file a claim to be reimbursed for costs to repair or replace the damaged phone. Please refer to the Guide to Benefits Cell Phone Protection insurance document on the BaZing website for additional information.

The Roadside Assistance benefit is up to $80 in services at no charge as long as you call the Roadside Assistance phone number on the YouFirst app or website and receive your service through a BaZing provider. You can also call BaZing Customer Service and be transferred to the Roadside Assistance partner to receive service. This is not a reimbursement service so you cannot secure your own service and request a refund of any costs up to $80. Please refer to the Terms and Conditions on the BaZing website for additional information.

Contact our Customer Care Center at 1-888-692-2654.

Did you open your account online and now need to finalize it?

If you recently opened your account online and you're trying to finalize your account. You should have received an email with instructions, however, you can also click the link below to complete your account opening process.

Member FDIC. Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions and may choose to limit deals. 1) Cell phone protection and personal identity theft benefit are subject to additional terms and conditions. 2) Insurance and wealth management products are: NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK.

Membership in YouFirst is $7 per month and will be automatically withdrawn from your YouFirst account. To avoid the $9 monthly service charge on your YouFirst Plus account, maintain $2,500 minimum average balance in your account. Membership in YouFirst Platinum with maximum benefits is $10 per month and will be automatically withdrawn from your account.

For electronic services, message and data rates may apply; contact your cellular provider for information on your mobile contract. Call us at 1-888-692-2654 if you are experiencing any issues. iPhone® is a trademark of Apple Inc., registered in the U.S. and other countries. App StoreSM is a service mark of Apple Inc. Android™ is a trademark of Google Inc.

Products offered by First United Wealth Management are not a deposit, not FDIC-insured, not insured by any federal government agency, not guaranteed by First United Bank & Trust, and may go down in value.

Please download these account disclosures and save them for your records.

* Accounts can only be opened in the following states and/or districts: West Virginia, Maryland, Pennsylvania, Ohio, Virginia, District of Columbia. Accounts cannot be opened by individuals under the age of 18. Charge for Non-First United (Foreign) ATM usage is $3.00 per transaction. Please note that the debit card ordered with these accounts will be our standard debit card. To customize your order, please contact our Customer Service Center at 1-888-692-2654 upon completing your account process.

Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions and may choose to limit deals.

Attention: When opening an Online Account, your digital access will be limited to read-only. If you need immediate access, please contact our Customer Service Center for verification. Otherwise, a member of our team will reach out to you on the next business day after account opening at the number provided at account setup.