Security of your money.

At First United Bank & Trust, we hold the security of your confidential information in the highest regard. We take measures to ensure your non-public data is secure and protected. This means working with you, keeping you up to date on the many different types of scams.

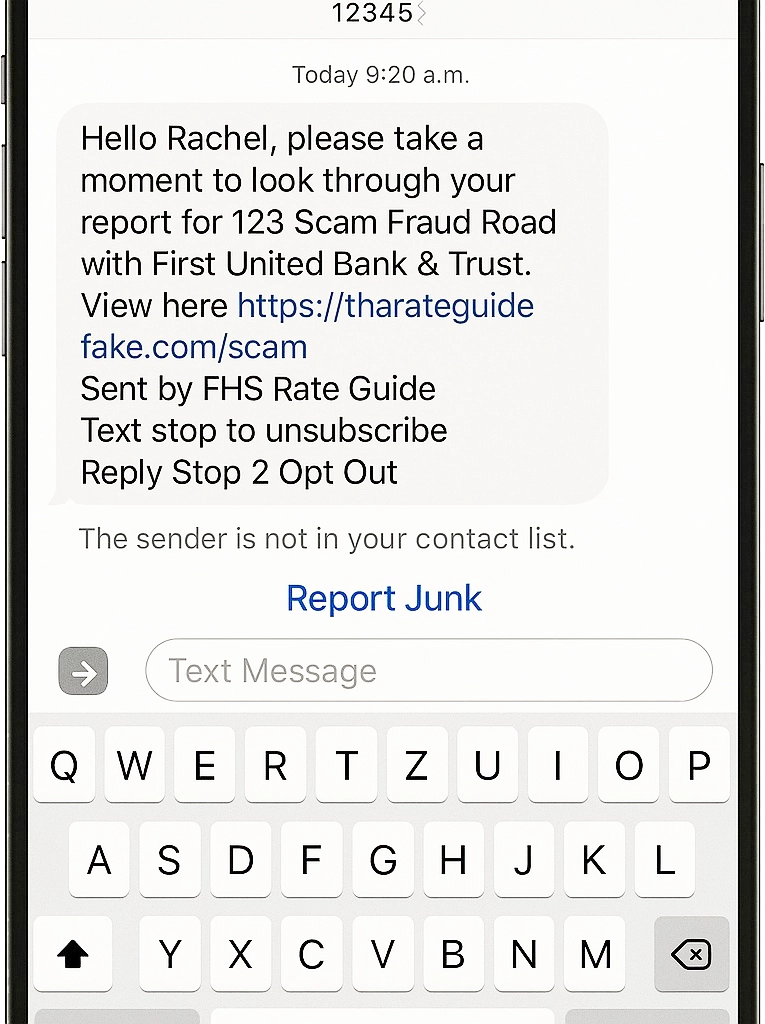

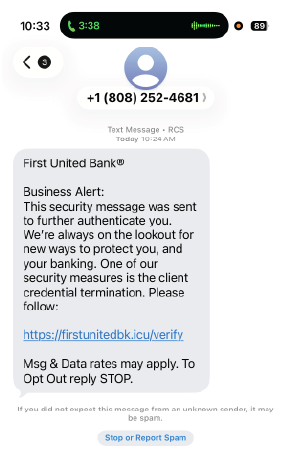

Sample Fraudulent Message

Safeguard your personal information!

First United Bank & Trust has been made aware of a recent surge in bank imposter scams targeting our customers.

Fraudsters continue efforts to pose as First United Bank & Trust through text messages and phone calls, attempting to trick individuals into clicking a link to “reset” their password or verify account details.

These messages may look legitimate, and in many cases, the scammers are even spoofing our official phone number, making the call or text appear as though it’s coming directly from the bank. They may use urgent language or threatening warnings to pressure you into taking quick action.

Important Note:

We will never ask you to click a link, provide login credentials, or share sensitive information through text message or over the phone.

If you receive an unexpected request like this, it is a scam.

Protect Yourself

✔ Never click on unexpected links

✔ Never share online banking credentials or one time security codes

✔ Hang up and call us directly if something feels off

✔ Save our official number in your phone for easy access

If you’re ever unsure whether a message or call is genuine, contact our

Customer Service Center immediately at 1-888-692-2654. We’re here to help keep your accounts safe.

Garrett County Businesses Warned of Rising Invoice Scams

The Garrett County Chamber of Commerce, in collaboration with the Garrett County State’s Attorney’s Office, has issued an important alert to local businesses regarding a surge in fraudulent invoice scams.

These scams are becoming increasingly sophisticated, with criminals sending fake invoices that closely resemble legitimate bills from vendors or government agencies. Often, these invoices demand immediate payment for goods or services that were never ordered or received.

While small businesses are frequently targeted, larger organizations and nonprofits are also at risk.

“The Chamber is committed to protecting the vitality of our business community,” said Nick Sharps, President of the Garrett County Chamber of Commerce. “These scams are designed to look routine, but a moment’s vigilance can prevent serious losses.”

🚨 Text Message Scam Alert 🚨

We’ve been notified of a new text scam targeting our community. These messages may appear to be from First United Bank & Trust, but they are not legitimate.

Never click suspicious links — especially on personal or company devices.

If you have received an unusual email, phone call or text from First United Bank & Trust, such as a request for personal login or password information – question it! Then take immediate action in one of these ways:

- contact our Customer Service Center at 1-888-692-2654

- forward suspicious emails to: abuse@mybank.com

When Bad Weather Hits, So Do the Fraudsters

Here are a few ways to protect yourself against scams:

- Watch for utility imposters, who will ask you to pay for repair or to replace equipment, and make sure to ask them for identification.

- Only hire licensed and insured contractors.

- Don’t pay for repairs or debris removal in cash.

Like, Share and Follow us on social!

Make sure to follow us on social media for the latest information on potential fraud and scams.

The Federal Trade Commission offers a variety of information about weather emergencies scams.

Can You Spot an Investment Scam?

Imagine this: a friend messages you out of the blue on social media. They say they’ve found a way to make quick money with little to no risk — and they want to show you how. Sounds tempting, right?

Hold up. That’s likely an investment scam.

The Rise of Crypto Scams

Investment scams, especially those involving cryptocurrency, are on the rise. In fact, the U.S. Department of Justice (DOJ) recently seized a staggering $225.3 million linked to alleged crypto investment scams. According to the DOJ, this is the largest cryptocurrency seizure in Secret Service history.

These scams often start with a relationship — sometimes even impersonating someone you know. Scammers build trust, then convince victims to “invest” in what appears to be a legitimate crypto opportunity. But behind the scenes, it’s a sophisticated scheme designed to steal your money.

Don’t Be a Victim of Identity Theft.

Have you become a victim of identity theft? Would you recognize it right away?

There are blatant examples of identity theft:

Money is gone from your checking account, your checks are bouncing, and/or there are charges on your debit or credit card you don’t recognize.

But there are more subtle signs that can hint that identity theft may be happening.

So what are the hallmarks?

- There is a sudden, unexplained drop in your credit score.

- Mail comes to your house, but it is in someone else’s name.

- You’re unable to log into online accounts and/or find them locked.

- You are notified that your personal information was part of a data breach.

What to do if you suspect your accounts have been compromised:

- Change online passwords.

- Review financial statements, and alert your financial institutions.

- Give your credit report a thorough review.

- Consider placing a security freeze on your credit report.

The American Bankers Association has helpful hints to help consumers watch for the signs of identity theft and what to do if you become a victim.

Protecting your online access is paramount for First United Bank & Trust, which is why we’ve included several security features to keep clients’ personal information safe.

Lead Treasury Management Specialist Mandy Shaffer talks about these security layers.

Report suspicious calls to the FTC by filing a consumer complaint form or calling the hotline, 1-877-FTC-HELP.

Learn how to prevent identity theft

Identity theft is on the rise, and scammers are finding new ways to access your personal information every day.

That’s why it’s important to keep a watchful eye on your finances and be alert, especially around the holidays when a lot of money is probably moving in and out of accounts.

At First United Bank & Trust, we’re committed to keeping our customers in the know about ways you can protect yourself and your assets.

Here are a few ideas to protect against identity theft:

- Choose unique PINs; avoid using Social Security numbers or birthdates.

- Tear up or shred receipts and bills before throwing them away.

- Check websites for an SSL certificate: Look for a lock symbol to the left of the company name and “https” in the URL.

- Be wary of pushy calls-to-action or limited-time offers that require your personal information.

- Watch out for telemarkers; offers of free trips and discounted magazine subscriptions are common scam tactics.

- Don’t give out bank account information or credit card or social security numbers to an unsolicited caller, even if the call is from a familiar company.

Can You Spot a Phishing Scam?

Helpful Steps to Protect Your Account

Following these steps can further protect your account and ensure safety on your digital banking journey.

Be sure to slow down, ask yourself questions and…

- think twice before clicking links, downloading attachments or replying to texts regarding your account information.

- never give out personal information in response to an unsolicited call or email.

- use strong passwords.

- set up Mobile or Internet Banking account alerts.

- use firewall software to protect your computer.

- update your operating system – check the Windows Update center on your PC to see available updates.

- run the latest browser technology. Click on your preferred browser to find the latest version: Edge | Firefox | Chrome

- exercise caution when posting information on social media.

Banks don’t do that!

First United Bank & Trust will NEVER…

- request your personal information (e.g., account number, Social Security number or mother’s maiden name) through email, U.S. mail, text or phone unless you initiate the contact or we are completing an application for you.

- request your online banking passcode – this should be kept safe and secure by you and not written or shared with anyone.

- send an email or text requesting that you click on a hyperlink to enter your login credentials or personal information.

Reporting issues

If you have received an unusual email, phone call or text from First United Bank & Trust, such as a request for personal login or password information – question it! Then take immediate action in one of these ways:

- contact our Customer Service Center at 1-888-692-2654

- forward suspicious emails to: abuse@mybank.com

Security Resources

Be sure to access our collection of fraud and security topics in our Finture Financial Education Center, powered by Banzai, along with these helpful articles:

- Finture Fraud and Security Insights

- 50 Internet Safety Tips for 2024

- ABA Cybersecurity Resources

- CISA Cyber Services & Tools

- Computer Security article FROM THE FTC

- Report identity theft by visiting the Federal Trade Commission at IdentityTheft.gov

- Protecting yourself from ID Theft from the MD Attorney General

- Identity Theft resources from the FDIC

- Recovering from identity theft? Use this interactive guide from the FTC to help you during the process.

- Small Business Guide

Podcasts

What Matters Most Podcast Episodes Related to Security

Blog articles

Love Is in the Air, But So Are Romance Scams

Romance scams are on the rise, and they can happen to anyone. These scams often start on dating apps, social media, or even through unexpected messages. The goal? To build trust and then exploit it.

Our Cookie Preferences have Updated

To give you more control over your data and create a more transparent browsing experience, we are introducing a new cookie consent pop‑up on our website.

Identity Theft Awareness Week: Steps to Protect Yourself

Identity Theft Awareness Week runs January 26-30, 2026, and it’s the perfect time to make safeguarding your identity part of your everyday routine, just like brushing your teeth or taking out the trash.

Watch Out for Bank Imposter Scams: What You Need to Know

Have you ever received a text that looks like it’s from your bank? It might say there’s suspicious activity on your account and urge you to act fast. Before you click or respond — pause. It could be a scam.

Financial Fraud Is on the Rise. Are You at Risk?

More than 1 in 5 U.S. adults have experienced financial fraud or scams involving their money, according to a new survey from the Federal Reserve. The findings come from the Fed’s 2024 report on the Economic Well-Being of U.S. Households, which, for the first time, asked Americans about their experiences with fraud and scams.

Giving Safely: Avoiding Charity Scams During the Holidays

The holiday season is a time of generosity, reflection, and giving back. But unfortunately, it’s also a prime time for scammers to take advantage of your goodwill. With so many donation requests flooding inboxes, social media feeds, and even text messages, it’s more important than ever to give wisely and protect yourself from charity scams.

December Is Identity Theft Protection Awareness Month. Here’s How to Stay Safe

Identity theft can happen to anyone, and during the holiday season, scammers are especially active. December is Identity Theft Protection Awareness Month, and at First United Bank & Trust, we’re committed to helping our community stay informed and protected.

That USPS Text could be a Scam

Getting a text about a package delivery might seem routine. But if that message includes a link and claims to be from USPS, FedEx, or DHL, there’s a good chance it’s a scam.

Gift Card Scams: What You Need to Know

If someone contacts you by phone, text, email, or social media and tells you the only way to fix a problem is by buying gift cards and sharing the numbers, it’s almost certainly a scam.

Check Fraud: The Archaic Scam That’s Still Costing People Thousands

Even in today’s fast-paced digital economy, where payments are made with a tap or a swipe, check fraud is still very much alive and growing. It may seem outdated, but scammers are increasingly reviving this old-school tactic, taking advantage of the fact that paper checks lack the robust security features built into modern payment systems.