My bank is…

here for our community.

Here to help…

You can call your local office; call (888) 692-2654 or contact us for support.

Providing Relief & Support

Our staff have been working day and night to reach out to support our customers. If you need help, we’re here for you:

- Mortgage Payment Relief

- Personal & Auto Loan Relief

- Business Loan Payment Relief

- SBA PPP Loan Needs

- Wealth & Investment Support

- Business Contingency Planning Support Tools & Information

- Financial Education Tools

- Setup & Use Our Digital Banking Tools

- Setup Contactless Payments

- Also, be sure to ask for eReceipts when making a deposit or withdraw in the drive-up

Health Savings & Benefits

We’re providing ALL customers with temporary NO COST pharmacy, vision and hearing savings and identity theft protection benefits, if you aren’t already receiving these benefits in your YouFirst checking account with First United.

Banzai Junior

Designed for kids aged 8 to 12, Banzai Junior uses the storyline of a summer lemonade stand and the goal of a new bike—or hoverboard for the financially daring—to teach concepts like interest and fees, envelope budgeting, and discretionary income. This course also weaves in activities like quizzes and counting currency.

Banzai Teen

Created for users aged 13-18, Banzai Teen gives teens the opportunity to work through real-life financial problems in a safe environment. Throughout the course, the user's goal is to save enough money to register at Vanderbilt Community College, but unforeseen challenges and quirky scenarios makes reaching that goal not-so-straightforward—just like real life!

Banzai Plus

Designed for users 16 and up, Banzai Plus calls for users to embrace adult-sized obstacles and learn about concepts from paying off debt to credit scores. Like all Banzai courses, Plus shows users how to spend their money on what matters most and how decisions have far-reaching consequences.

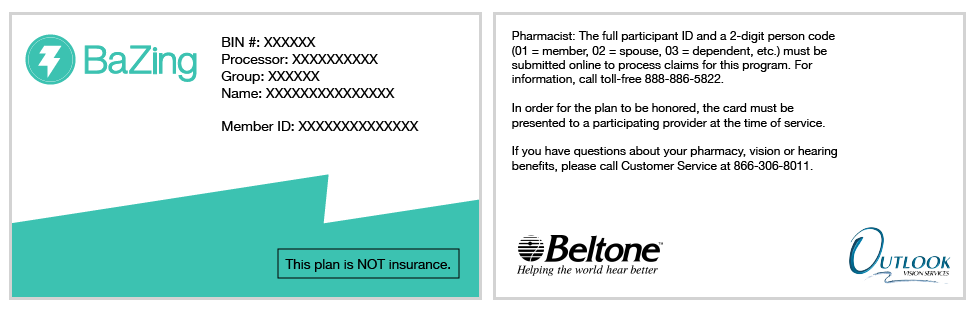

Prescriptions, Eye and Hearing Care

Save On Local Pharmacy Prescriptions

How to Use Your Health Savings Card

Print & Present Your Card

Present your printed Health Savings card (or the screenshot on your mobile phone) to your local pharmacist at a participating pharmacy. There are no forms to fill out, receipts to send in, or deductibles to pay. Your savings are at the point of purchase.

Whole Household Use

Anyone in the household can use the card or individuals in a household may have their own card, simply by printing their own card.

Not an Insurance Card

The card cannot be used in conjunction with insurance or other discounts, but rather one or the other (whichever provides the greater discount).

Find Participating Pharmacies

Find participating pharmacies in your area or across the U.S. by using our Health Provider Search found at the link below.

Helping You Save On Mail-Order Prescriptions

Our mail-order pharmacy program provides material savings on name-brand or generic maintenance medication and has prescriptions delivered right to your home. This service provides a convenient, cost-efficient and safe way to purchase a 30-90 day supply of maintenance drugs at reduced prices.

Simply call toll-free at 888-479-2000 and select option 0.

A Customer Care Representative will assist you 24/7.

The Health Savings card is not needed for mail-order pharmacy.

Save on Eye & Hearing Care

Get discounts on frames, lenses, eye exams, contact lenses and LASIK surgeries at participating providers.

Receive discounts on contact lenses by calling 1-800-CONTACTS and mentioning the code “Outlook Vision.” Many vision insurance plans cover either glasses or contacts once per year. You may use your vision insurance for one and your Health Savings card for the other.

Save up to 15% on over 70 models of hearing aids through a nationwide network of hearing care offices. Purchases are backed by the Belcare Member Satisfaction Program, which includes free hearing aid inspections, cleanings and adjustments.

Schedule

Present Your Card

Find Providers

Find Providers

More Details

To learn more details about Personal Identity Theft Benefit, including what’s covered and how to obtain your reimbursement, view the Guide to Benefits.

Contact a Benefits Administrator

After reviewing the Guide to Benefit, if you’re eligible for reimbursement, contact the benefit administrator and we will then assist you through the necessary steps.

What We’re Doing…

We’ve reached out to all our older and at risk customers to offer assistance. We’re checking in to make sure they’re safe and well. We’re doing the same for our local, community businesses.

We’ve moved to a strict limited lobby experience to keep our staff and community safe, while also enhancing our cleaning efforts in the offices around the drive-up tools.

We offer remote banking options, mobile banking tools, advanced function ATMs and can help customers remotely by phone and chat as needed.

Safe & Secure

Your funds are safe and secure and covered by the FDIC.

Safety Tips

Keep your finances safe by following best practices when it comes to digital interactions with others. Fraud is on the rise.

News & Updates

Giving Safely: Avoiding Charity Scams During the Holidays

The holiday season is a time of generosity, reflection, and giving back. But unfortunately, it’s also a prime time for scammers to take advantage of your goodwill. With so many donation requests flooding inboxes, social media feeds, and even text messages, it’s more important than ever to give wisely and protect yourself from charity scams.

December Is Identity Theft Protection Awareness Month. Here’s How to Stay Safe

Identity theft can happen to anyone, and during the holiday season, scammers are especially active. December is Identity Theft Protection Awareness Month, and at First United Bank & Trust, we’re committed to helping our community stay informed and protected.

That USPS Text could be a Scam

Getting a text about a package delivery might seem routine. But if that message includes a link and claims to be from USPS, FedEx, or DHL, there’s a good chance it’s a scam.