Save more money with Billshark and BaZing!

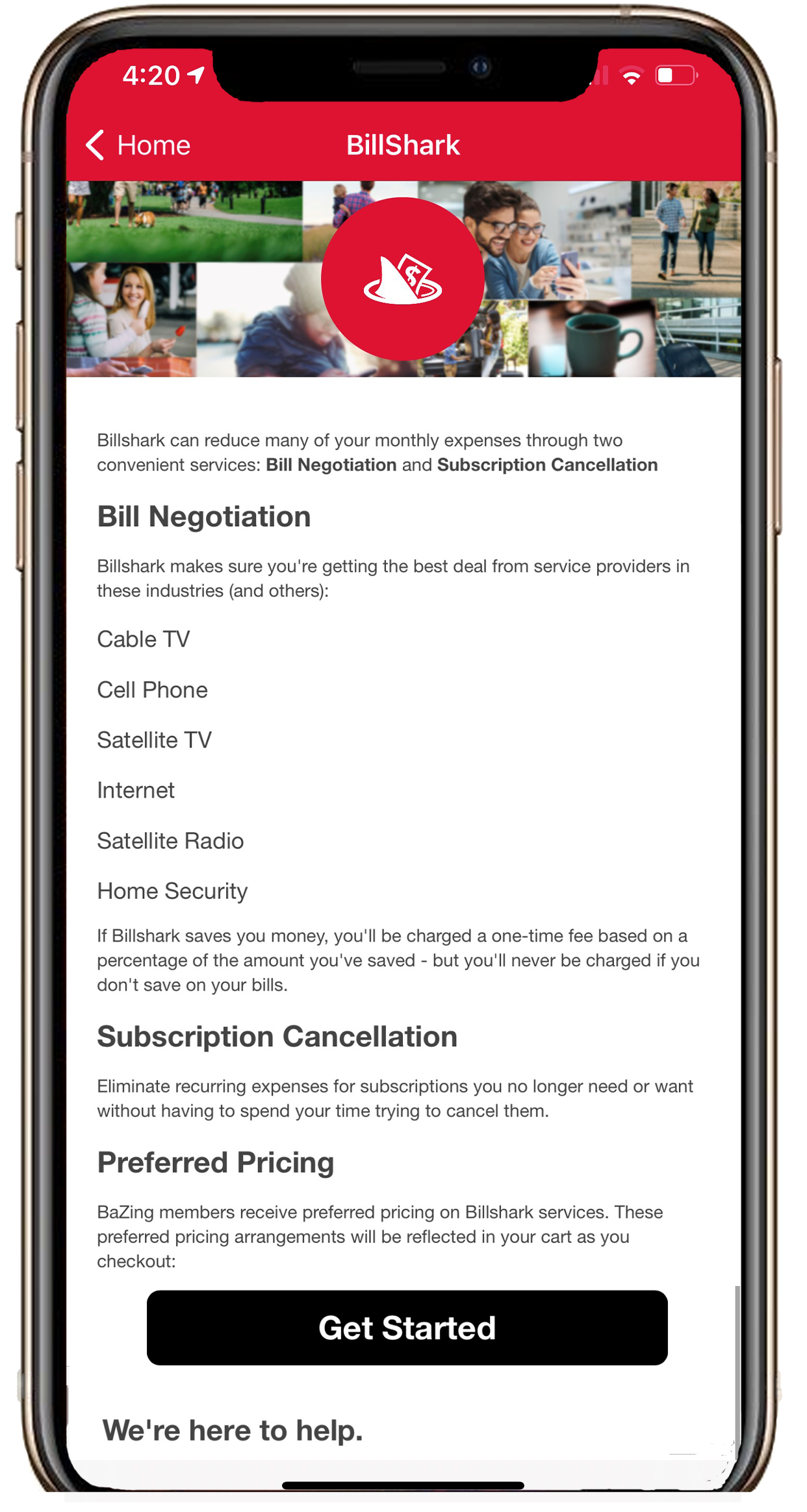

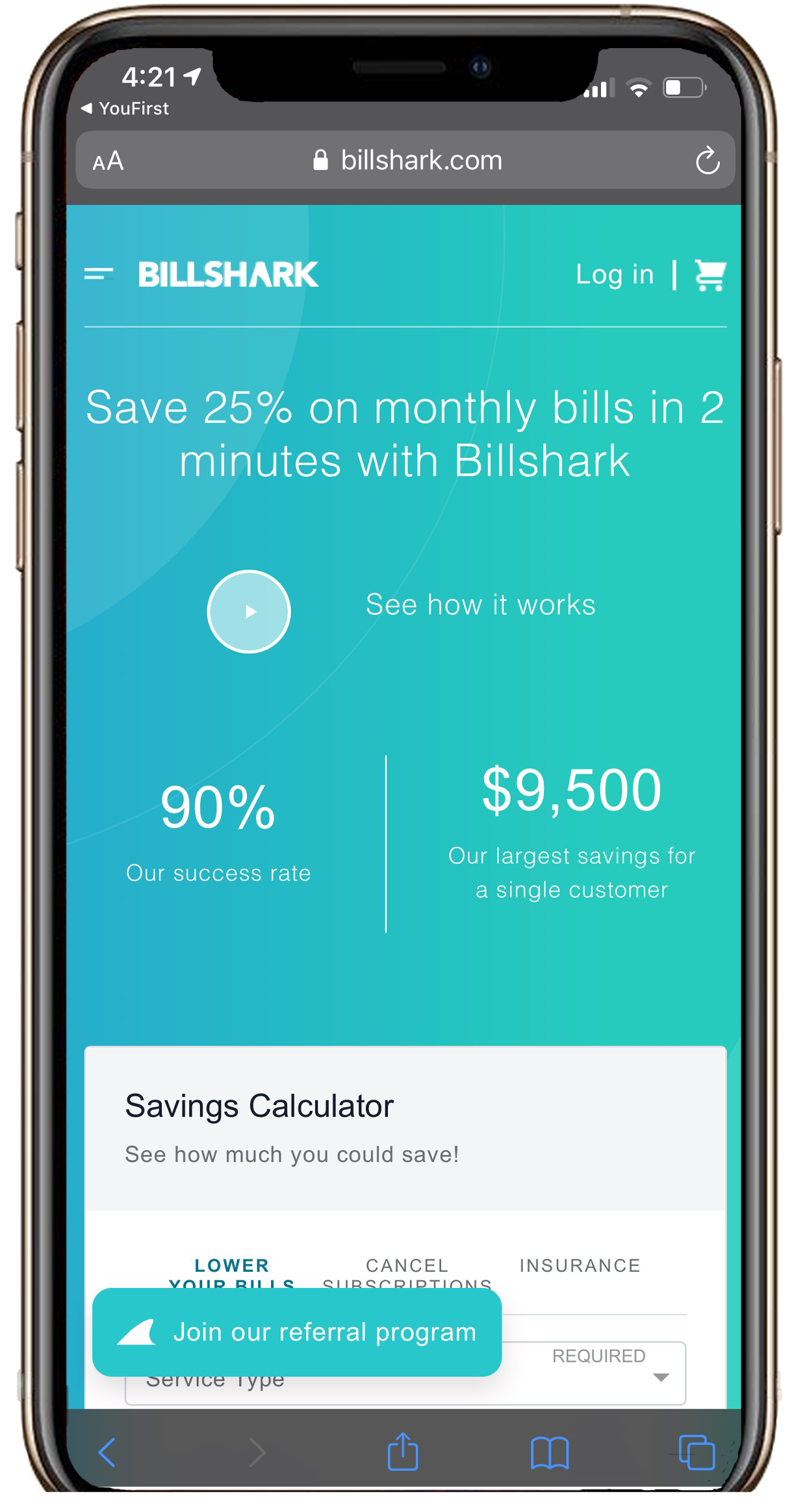

This exciting new BaZing feature gives you bill negotiation and subscription cancellation services at special, members-only rates.

Billshark is included with your powerful YouFirst checking account! This means no more endless email threads or long, drawn-out phone conversations: Billshark’s team of experts (called Sharks) can handle bill negotiations and subscription cancellation requests for you — saving time, money, and stress!

- Cable and satellite TV

- Cell phone

- Internet and satellite radio

- TV, internet, and phone bundles

- Home security bills

- Unwanted subscription services (like Netflix, Hello Fresh, and StitchFix)

What’s the Catch?

There’s no cost to try it out — Billshark guarantees savings, or it’s free. Once you’ve viewed your no-risk Savings Estimate, you decide if you want a Shark to handle bill negotiation or subscription cancellation. If not, you won’t pay a penny.

- As a BaZing member, you’ll pay Billshark a one-time fee of 33% of your total savings stemming from a bill negotiation (compared to 40% for non-BaZing customers).

- Each canceled subscription handled by your Shark costs $7 (compared to $9 for non-BaZing customers).

Commit to Memory - 5 key benefits of Billshark:

- Save Money

- Save Time/create convenience

- Security/peace of mind

- Benefit Reference Guides - available on applicable checking product page

- There are no fees for trying

- Bill Negotiation fees are reduced to 33% of the money saved vs 44% for non-BaZing members

- Subscription Cancellation services are priced at $7 each vs $$9 for non-members

- Members will receive an invoice shortly following the completion of your bill negotiation. If the customer provided a credit card when enrolling, the card will be charged. Otherwise, the customer will receive an invoice from Billshark

Additional FAQs are available within the "Get Started" page of the Billshark option.

Get started

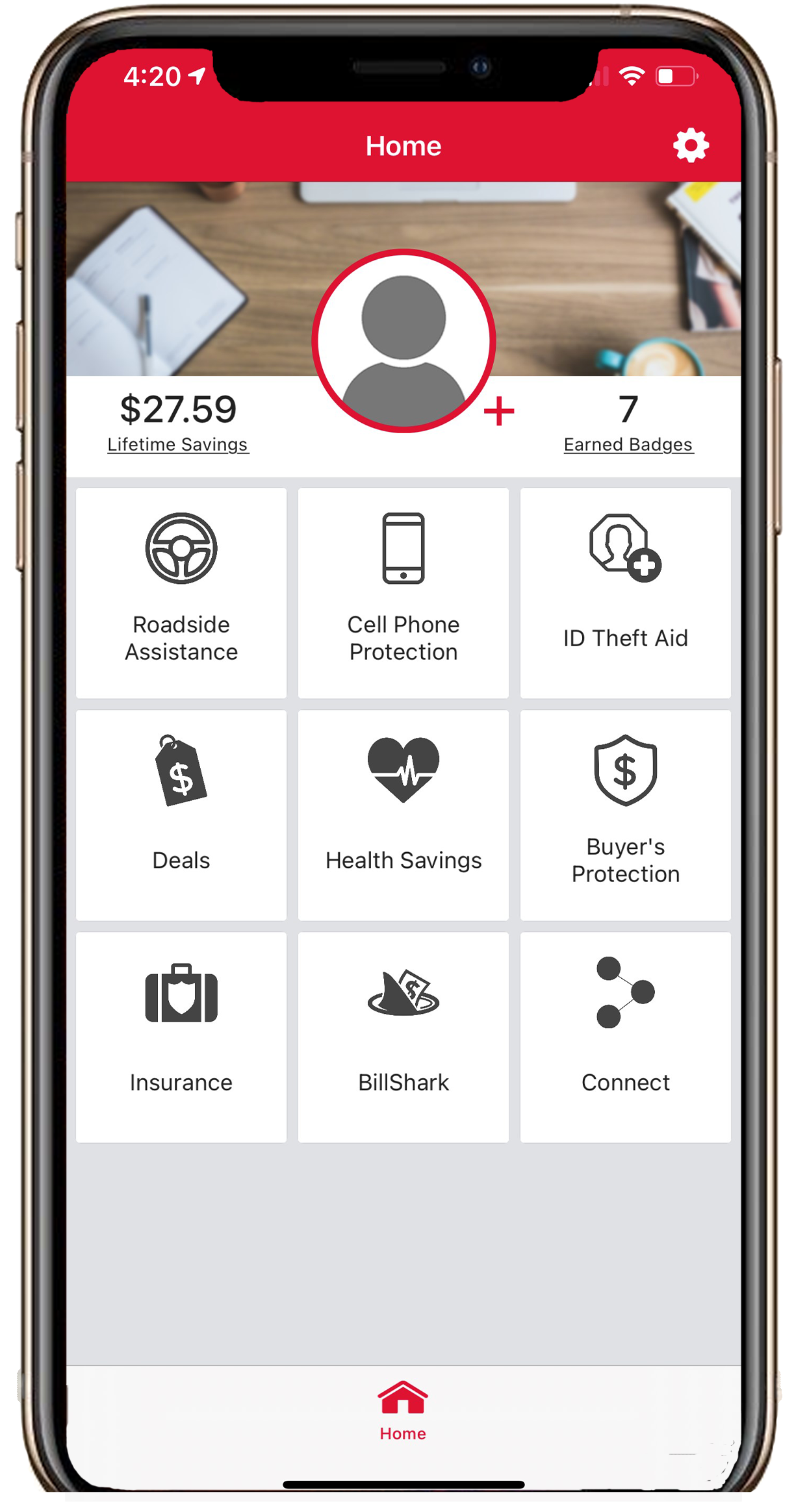

Ready to begin saving money? Download the YouFirst Mobile app, tap the tile for Billshark, and put a Shark to work for you!

- YouFirst Checking

- YouFirst Plus Checking

- YouFirst Platinum Checking

- Freedom First Checking

- Overdraft Services

- Debit Cards

- My Bank Rewards

- Billshark

- Safe Deposit Boxes

- Reorder Checks

Reordering Checks?

Use Routing Number: 052100987

1. Open your YouFirst app and tap Billshark.

2. Enter your bill or subscription details in the Savings Estimator, review your Savings Estimate, enter your payment details, then tap Check Out.

3. Your bill will be assigned to a Shark who will call, text, or email you with additional information.

Explore Our Checking Account Options:

Be sure you enable location services and select the option “always”. Also, verify notifications are turned on inside the YouFirst app. While logged into the app click on ‘More’. Scroll to Manage Notifications and click. Make sure ‘Turn on Notifications’ is set to on. Sometimes turning it off and on will also help with notification issues.

In the YouFirst app, click Manage Notifications and you can choose to ‘Mute’ certain merchants.

With over 360,000 deals, while rare, there could be an occasion where a deal doesn’t work. With our guarantee, you simply click “I had a problem” and submit a receipt and you’ll receive a check for the amount of the discount you should have received.

Contact Bazing at 1-855-UBAZING (1-855-822-9464) or customer.service@bazing.com

All of the benefits take effect immediately with the exception of the Cell Phone Protection coverage. This benefit begins and renews the first day of the month following a cell phone bill payment from the YouFirst checking account. If a payment is not made in a given month the coverage will be suspended the first day of the following month. Please refer to the Guide to Benefits Cell Phone Protection insurance document on the BaZing website for additional information.

BaZing applications may collect real time location information for the purpose of providing the customer with services but are only done so with the permission of the user. Collection of data/information by BaZing via mobile applications will only include location information and user favorites in order to provide pertinent data regarding service offerings.

With over 360,000 deals, while rare, there could be an occasion where a deal doesn’t work. With our guarantee, you simply click “I had a problem” and submit a receipt and you’ll receive a check for the amount of the discount you should have received.

The BaZing Guarantee states if an offer that is listed on the website or app is not honored and you go ahead and make the purchase as listed on the offer you can send in your receipt with a description of your experience to BaZing Customer Service and we will issue a refund.

You can also send an email to BaZing Customer Service with the merchant name, location and issue experienced. If additional information is needed it will be gathered at that time. Or, if the customer is using the app there is a way to send a notice to Customer Service directly from the app. When you close the offer there are different options to choose. One of those is ‘I had a problem’. This means that for whatever reasons there was an issue with redeeming the offer. When you select that option; you are given the option of adding a picture of the receipt. Simply click the ‘camera’ icon to do that. Then click ‘submit’.

The maximum refund is $100.

You will need to file a claim. The claim form can be printed from the BaZing website or you can contact BaZing Customer Service and they can send you one via email. You will need to fill it out and send in the required documents. After the claim is reviewed you will receive a Summary of Benefits along with a check, if the claim is payable. Please refer to the Guide to Benefits Cell Phone Protection insurance document on the BaZing website for additional information.

If a cell phone is damaged to the point that you cannot make or receive phone calls then you are eligible to file a claim to be reimbursed for costs to repair or replace the damaged phone. Please refer to the Guide to Benefits Cell Phone Protection insurance document on the BaZing website for additional information.

The Roadside Assistance benefit is up to $80 in services at no charge as long as you call the Roadside Assistance phone number on the YouFirst app or website and receive your service through a BaZing provider. You can also call BaZing Customer Service and be transferred to the Roadside Assistance partner to receive service. This is not a reimbursement service so you cannot secure your own service and request a refund of any costs up to $80. Please refer to the Terms and Conditions on the BaZing website for additional information.

Contact our Customer Care Center at 1-888-692-2654.

Member FDIC. Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions and may choose to limit deals. 1) Cell phone protection and personal identity theft benefit are subject to additional terms and conditions. 2) Insurance and wealth management products are: NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK.

Membership in YouFirst is $7 per month and will be automatically withdrawn from your YouFirst account. To avoid the $9 monthly service charge on your YouFirst Plus account, maintain $2,500 minimum average balance in your account. Membership in YouFirst Platinum with maximum benefits is $10 per month and will be automatically withdrawn from your account.

For electronic services, message and data rates may apply; contact your cellular provider for information on your mobile contract. Call us at 1-888-692-2654 if you are experiencing any issues. iPhone® is a trademark of Apple Inc., registered in the U.S. and other countries. App StoreSM is a service mark of Apple Inc. Android™ is a trademark of Google Inc.

Products offered by First United Wealth Management are not a deposit, not FDIC-insured, not insured by any federal government agency, not guaranteed by First United Bank & Trust, and may go down in value.

Please download these account disclosures and save them for your records.

* Accounts can only be opened in the following states and/or districts: West Virginia, Maryland, Pennsylvania, Ohio, Virginia, District of Columbia. Accounts cannot be opened by individuals under the age of 18. Charge for Non-First United (Foreign) ATM usage is $3.00 per transaction. Please note that the debit card ordered with these accounts will be our standard debit card. To customize your order, please contact our Customer Service Center at 1-888-692-2654 upon completing your account process.

Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions and may choose to limit deals.

Attention: When opening an Online Account, your digital access will be limited to read-only. If you need immediate access, please contact our Customer Service Center for verification. Otherwise, a member of our team will reach out to you on the next business day after account opening at the number provided at account setup.

Did you open your account online and now need to finalize it?

If you recently opened your account online and you're trying to finalize your account. You should have received an email with instructions, however, you can also click the link below to complete your account opening process.