My bank is here for our community.

We’re doing everything we can to help support our local customers, businesses and communities through this challenging time. If you have been impacted by a recent or upcoming major life event, please reach out to us, or attend one of our upcoming seminars. Our advisors are here to help.

Upcoming Events

July

No Events

We’re here and happy to help…

You can call your local office; call (888) 692-2654 or contact us for support.

We're here to help...

We believe that by being proactive, we can help support our community during challenging times. If you have been impacted by recent events or upcoming closures at local businesses; please reach out to us. Our team of experts can help you plan for a future that may seem uncertain.

Health Savings & Benefits

We’re providing ALL customers with temporary NO COST pharmacy, vision and hearing savings and identity theft protection benefits, if you aren’t already receiving these benefits in your YouFirst checking account with First United.

Banzai Junior

Designed for kids aged 8 to 12, Banzai Junior uses the storyline of a summer lemonade stand and the goal of a new bike—or hoverboard for the financially daring—to teach concepts like interest and fees, envelope budgeting, and discretionary income. This course also weaves in activities like quizzes and counting currency.

Banzai Teen

Created for users aged 13-18, Banzai Teen gives teens the opportunity to work through real-life financial problems in a safe environment. Throughout the course, the user's goal is to save enough money to register at Vanderbilt Community College, but unforeseen challenges and quirky scenarios makes reaching that goal not-so-straightforward—just like real life!

Banzai Plus

Designed for users 16 and up, Banzai Plus calls for users to embrace adult-sized obstacles and learn about concepts from paying off debt to credit scores. Like all Banzai courses, Plus shows users how to spend their money on what matters most and how decisions have far-reaching consequences.

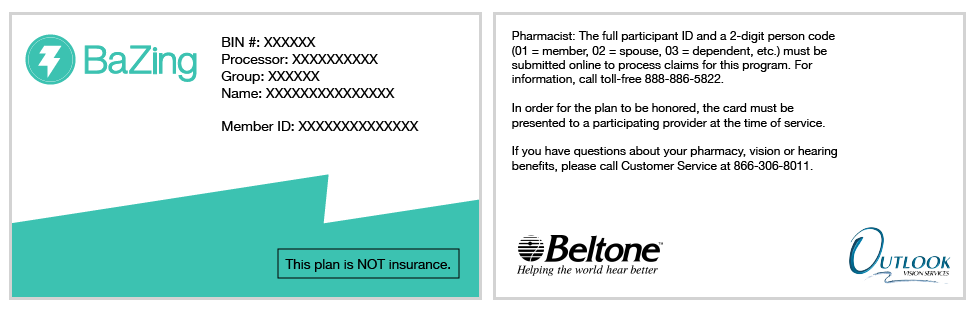

Prescriptions, Eye and Hearing Care

Save On Local Pharmacy Prescriptions

How to Use Your Health Savings Card

Print & Present Your Card

Present your printed Health Savings card (or the screenshot on your mobile phone) to your local pharmacist at a participating pharmacy. There are no forms to fill out, receipts to send in, or deductibles to pay. Your savings are at the point of purchase.

Whole Household Use

Anyone in the household can use the card or individuals in a household may have their own card, simply by printing their own card.

Not an Insurance Card

The card cannot be used in conjunction with insurance or other discounts, but rather one or the other (whichever provides the greater discount).

Find Participating Pharmacies

Find participating pharmacies in your area or across the U.S. by using our Health Provider Search found at the link below.

Helping You Save On Mail-Order Prescriptions

Our mail-order pharmacy program provides material savings on name-brand or generic maintenance medication and has prescriptions delivered right to your home. This service provides a convenient, cost-efficient and safe way to purchase a 30-90 day supply of maintenance drugs at reduced prices.

Simply call toll-free at 888-479-2000 and select option 0.

A Customer Care Representative will assist you 24/7.

The Health Savings card is not needed for mail-order pharmacy.

Save on Eye & Hearing Care

Get discounts on frames, lenses, eye exams, contact lenses and LASIK surgeries at participating providers.

Receive discounts on contact lenses by calling 1-800-CONTACTS and mentioning the code “Outlook Vision.” Many vision insurance plans cover either glasses or contacts once per year. You may use your vision insurance for one and your Health Savings card for the other.

Save up to 15% on over 70 models of hearing aids through a nationwide network of hearing care offices. Purchases are backed by the Belcare Member Satisfaction Program, which includes free hearing aid inspections, cleanings and adjustments.

Schedule

Present Your Card

Find Providers

Find Providers

More Details

To learn more details about Personal Identity Theft Benefit, including what’s covered and how to obtain your reimbursement, view the Guide to Benefits.

Contact a Benefits Administrator

After reviewing the Guide to Benefit, if you’re eligible for reimbursement, contact the benefit administrator and we will then assist you through the necessary steps.

News & Updates

Smart Borrowing: Solutions for Managing Student Loan Debt

College is more than an education — it’s the start of a new chapter, full of possibilities. However, for many students, the cost of higher education is a major financial hurdle. First United Bank & Trust loans cover tuition, housing, books, and supplies, so students can focus on learning and shaping their future.

First United Bank & Trust celebrates 125 years of community, commitment, and growth

First United Bank & Trust proudly celebrates its 125th anniversary in 2025, marking a significant milestone in its journey from a small-town bank to a trusted financial partner across multiple states. Founded in 1900 as the First National Bank of Oakland, the institution has grown to include 22 branches and more than 300 associates — yet its heart remains rooted in community.

First United introduces exclusive Solutions at Work program to enhance workplace financial services

First United Bank & Trust is thrilled to announce an exclusive opportunity for businesses through its Solutions at Work program. Designed to provide seamless financial solutions for employers and employees alike, this program prioritizes convenience, while delivering valuable benefits tailored to workplace success.

Got questions? Ask away!

Frequently Asked Questions

If you have encountered financial hardship as a result of the Coronavirus (COVID-19) and looking for assistance, contact your relationship manager or our Customer Service Center:

Customer Service Center – 1-888-692-2654

Monday – Friday 8:00 a.m. – 8:00 p.m.

Saturday 9:00 a.m. – 1:00 p.m.

Yes, our offices remain open for business. To help prevent the spread of COVID-19, we have heavy restrictions on all lobby access and recommend the use of our digital banking services, ATMs, and drive-up facilities. Please check your nearest office location before visiting us.

Yes. There is no disruption to our ATM network. Machines located outside of a lobby are a great alternative for checking account balances, depositing cash or checks, making cash withdrawals, and transferring funds between other First United accounts. Business customers can also continue to use our Night Drop service.

Alternative ways of branch banking are not new due to the coronavirus outbreak. To help you quickly identify an alternative to many of your common lobby banking needs, review our reference guide and continue to stay connected with us through this website, email and social media.

First United Digital Banking Solutions are a great way to bank anywhere, anytime. We’ve got you covered, offering Personal and Business Online (Internet) and Mobile Banking, Bill Pay or person to person payment options, Mobile deposit, card alerts and much more. Get started by reviewing tutorials, enrolling or downloading the app OR contacting our Customer Service Center at 1-888-692-2654 for assistance.

Further restricting lobby access to a ‘closed’ status means we are complying with federal, state and local government directives to help reduce the spread of coronavirus (COVID-19). We want to stay connected with you in a safe manner. Therefore, our Drive-up lanes remain open during normal business hours along with 24/7 access to our ATM network and Digital Banking solutions.

Should you have a need to access our branch lobby for services such as Safe Deposit box access, or have any questions during this time, please call your local office or our Customer Service Center at 1-888-692-2654. We will do our best to accommodate your needs quickly and safely. Our offices continue to perform recommended daily cleaning measures, but should you be permitted to enter the branch, you will be asked to wear the provided mask and use hand sanitizer or gloves, appropriately.

First United cleans/disinfects high touch areas, like the drive-up tubes, multiple times throughout the day. If you have concerns about the drive-up equipment, we suggest that you consider utilizing gloves when touching this equipment and remove them immediately after.