Our team is here for you, for life!

In a time when it seems like so many banks are just the same, First United is here with the heart to be different. It’s not just that we’re locally owned with a team that lives and works in the places you call home, it’s that we’re dedicated to helping you. We build solutions that are so customized, you’d swear we only had one customer–you!

That’s why our customers call us “my bank.” We can’t wait for you to see just what we have to offer.

Latest from the Blog

Smart Borrowing: Solutions for Managing Student Loan Debt

College is more than an education — it’s the start of a new chapter, full of possibilities. However, for many students, the cost of higher education is a major financial hurdle. First United Bank & Trust loans cover tuition, housing, books, and supplies, so students can focus on learning and shaping their future.

First United Bank & Trust celebrates 125 years of community, commitment, and growth

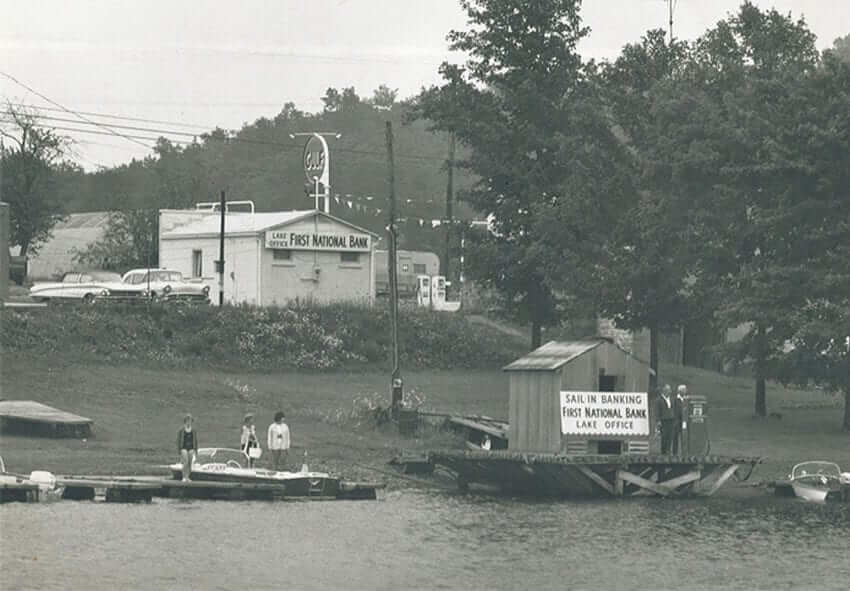

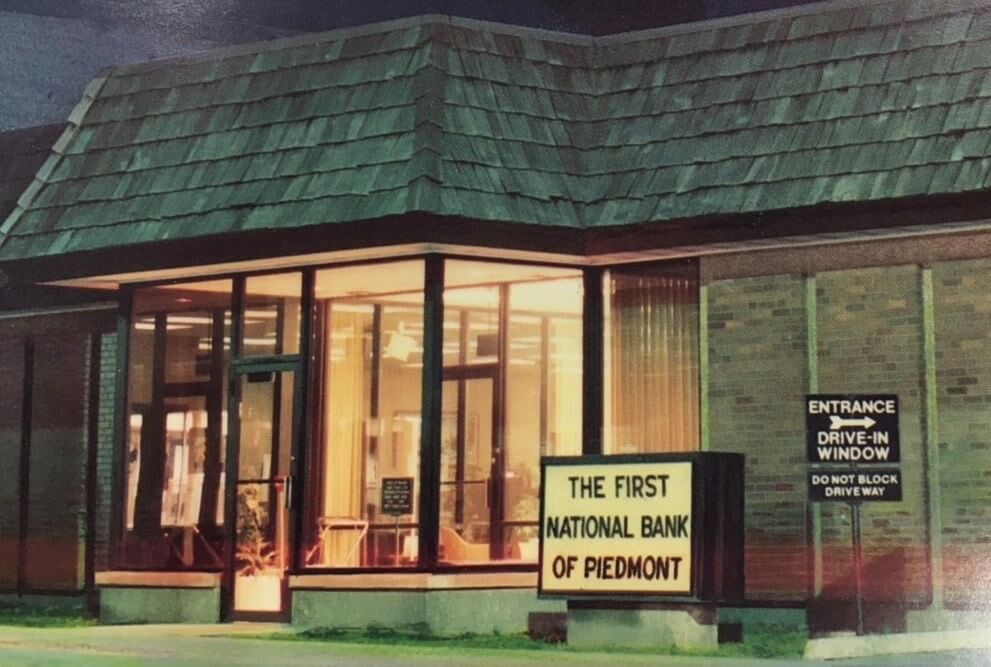

First United Bank & Trust proudly celebrates its 125th anniversary in 2025, marking a significant milestone in its journey from a small-town bank to a trusted financial partner across multiple states. Founded in 1900 as the First National Bank of Oakland, the institution has grown to include 22 branches and more than 300 associates — yet its heart remains rooted in community.

First United introduces exclusive Solutions at Work program to enhance workplace financial services

First United Bank & Trust is thrilled to announce an exclusive opportunity for businesses through its Solutions at Work program. Designed to provide seamless financial solutions for employers and employees alike, this program prioritizes convenience, while delivering valuable benefits tailored to workplace success.

The Value of Overdraft Services: A Financial Safety Net for Consumers

Managing personal finances can be unpredictable, and sometimes expenses exceed available funds. In those moments, overdraft services offered by financial institutions like First United Bank & Trust serve as a crucial safety net, helping consumers avoid the inconvenience and potential harm of declined payments.

First United Bank & Trust establishes fund and special loan offer, helps community after devastating flooding

First United Bank & Trust is proud to announce additional relief options to support communities affected by recent storms and flooding within Maryland and West Virginia.

First United welcomes Coty Thorne to Commercial Relationship Manager role

Tanner Russell, Director of Commercial Services at First United Bank & Trust, recently welcomed Coty Thorne to the bank as Commercial Relationship Manager.